Business Insurance in and around Stone Mountain

Get your Stone Mountain business covered, right here!

Insure your business, intentionally

Your Search For Great Small Business Insurance Ends Now.

Small business owners like you have a lot on your plate. From product developer to tech support, you do whatever is needed each day to make your business a success. Are you a pet groomer, a sporting goods store or a dentist? Do you own a pottery shop, an auto parts shop or a bridal shop? Whatever you do, State Farm may have small business insurance to cover it.

Get your Stone Mountain business covered, right here!

Insure your business, intentionally

Surprisingly Great Insurance

When one is as driven about their small business as you are, it makes sense to want to make sure all bases are covered. That's why State Farm has coverage options for surety and fidelity bonds, artisan and service contractors, worker’s compensation, and more.

As a small business owner as well, agent James Brown understands that there is a lot on your plate. Reach out to James Brown today to get more information on your options.

Simple Insights®

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

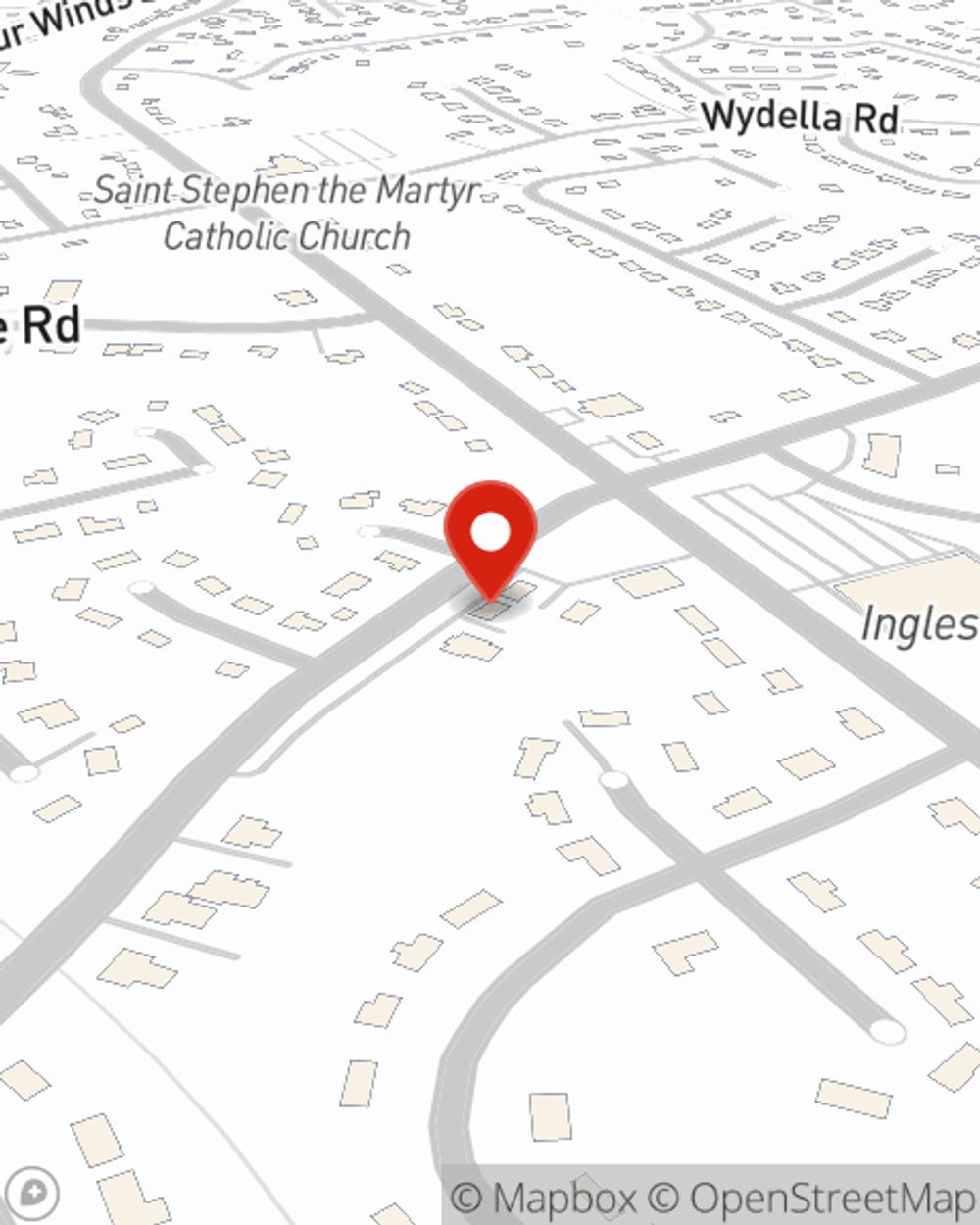

James Brown

State Farm® Insurance AgentOffice Address:

Suite B

Stone Mountain, GA 30087-3519

Simple Insights®

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.